Before I officially registered as a freelancer in Portugal, I heard about ‘recibos-verdes’. That sounded beautiful and mysterious in Portuguese. The only thing I understood at the time was that these were the bills sent by freelancers. But why were they called like that…?

This article was updated and checked in dec. 22

What is a recibo verde?

Um recibo verde, literally a green receipt, is only issued in Portugal by a ‘trabalhador independente’, a self-employed worker. The name comes from the official receipt booklet (caderneta de recibos) that freelancers used to write bills. At the end of the year they had to submit this booklet at their local tax office.

Nowadays, a freelancer can only issue a bill digitally via the portal of the Portuguese tax authorities. You can make different types of bills via the portal. Such as bills awaiting payment, paid bills and there is even an option to create bills where the recipient already pays part of your income tax duties. You are obliged to enter the invoice immediately upon delivery of the work and send it to your customer, but of course, no one does that and there is no strict control.

To be honest, I really don’t know all the possibilities and rules for making recibos verdes. So I’ll just show what I’m doing, below. In this blog, I only want to unravel the mystery of the ‘recibos verdes’ for the starting trabalhador independente.

How to make a Portuguese bill?

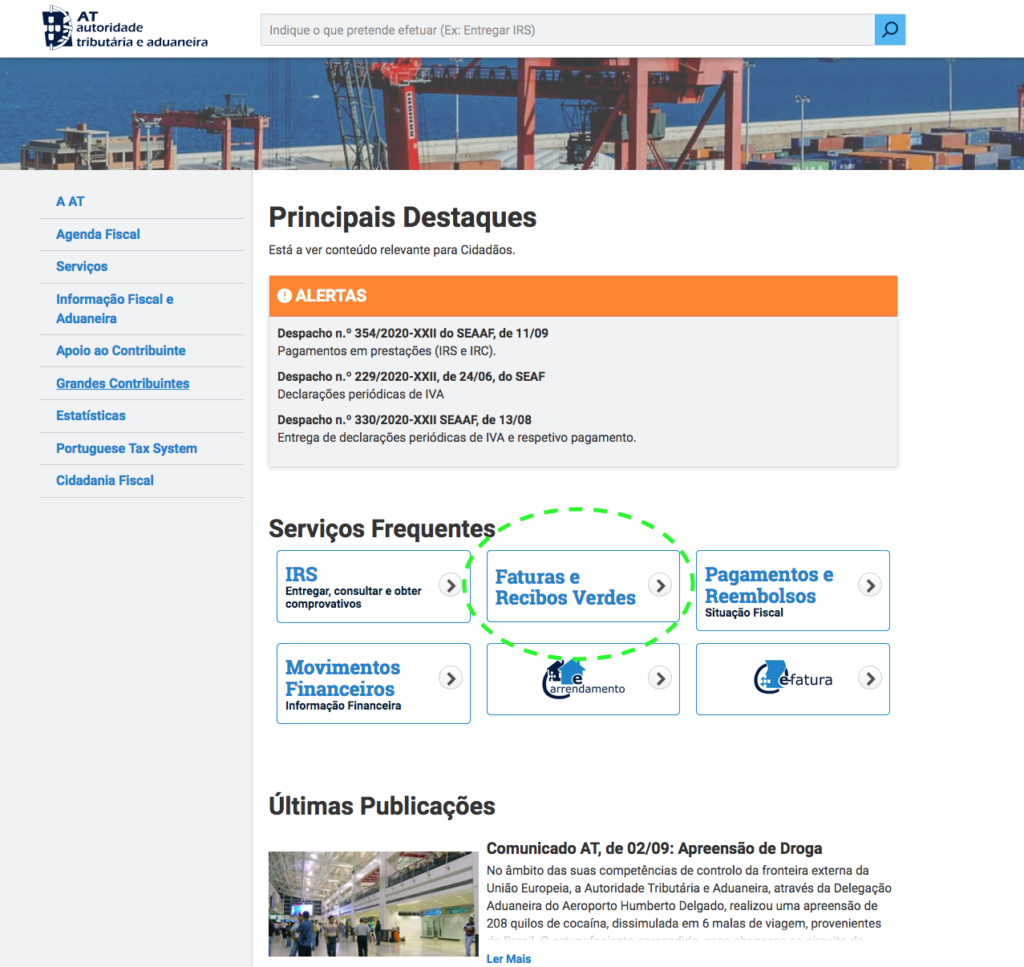

Go to the portal of the Portuguese Tax Office and log in: as finanças.

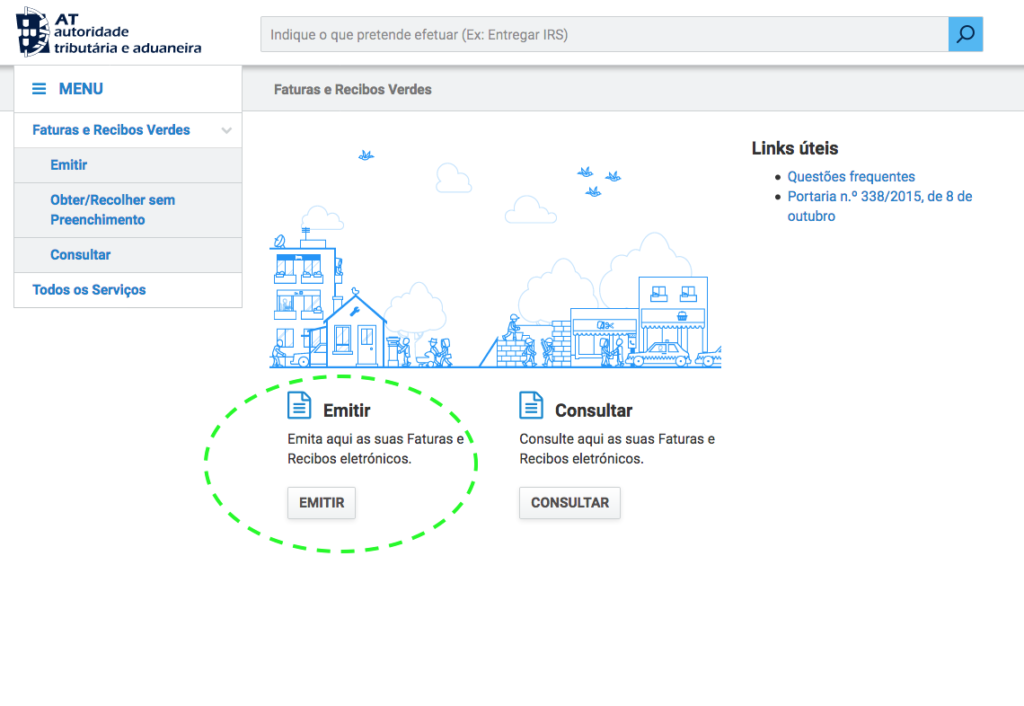

On the front page, you will see ‘faturas e recibos verdes’. (marked by the dotted green circle)

You can then choose whether you want to create a new bill (emitir) or whether you want to consult previously submitted bills (consultar).

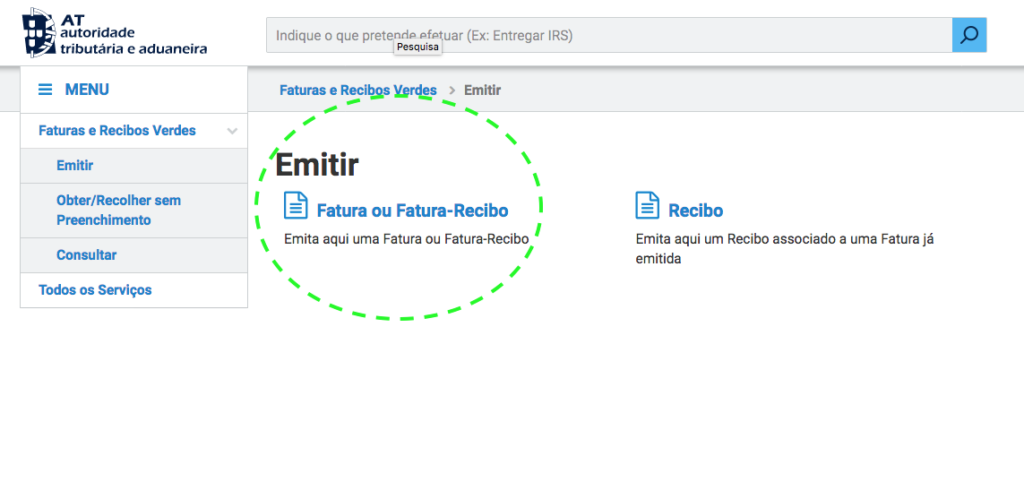

After that you choose to make a bill (fatura), a paid bill (fatura-recibo) or just a receipt (recibo).

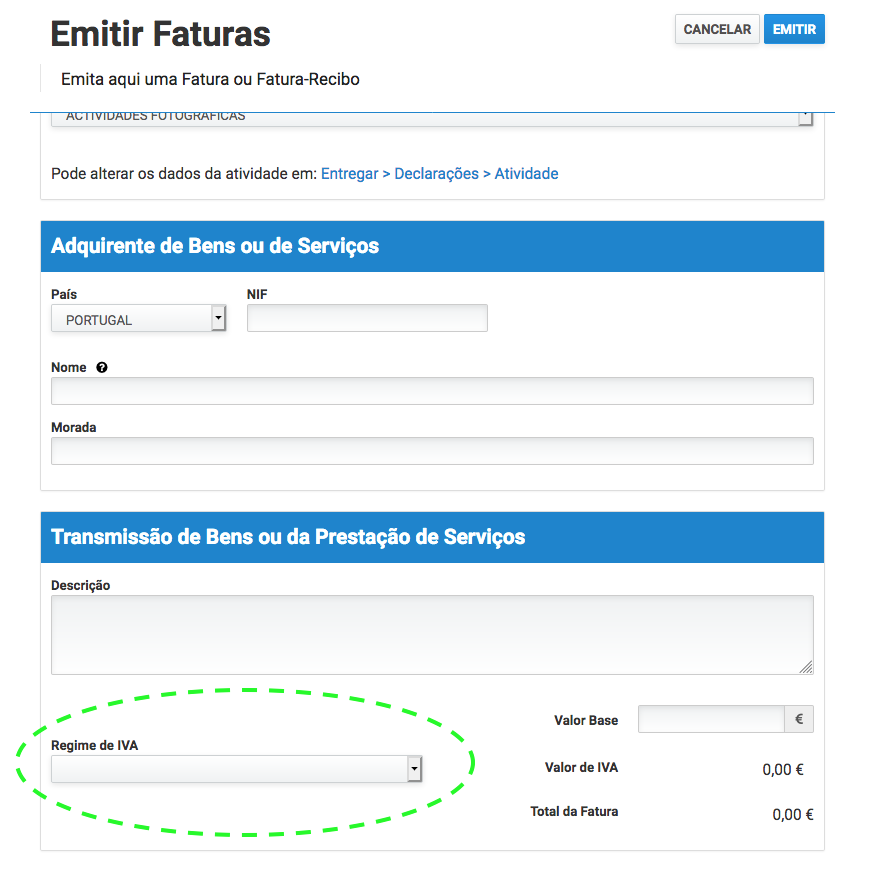

Now you enter the page where you can create a new bill. At the top, your personal details are shown, which I have left out of the picture, because of my privacy. From a pop-down menu, you choose under which of your business activities the delivery falls. (You had to indicate these when you registered your company. For an explanation of business codes, see here).

Below this, you enter the details of the recipient.

If like me, you regularly work for companies in the EU, you do not have to charge VAT as long as your client is registered in VIES with their VAT number. Copy the exact data from this register when you have checked the client’s VAT number there. Only then, you are allowed not to charge VAT.

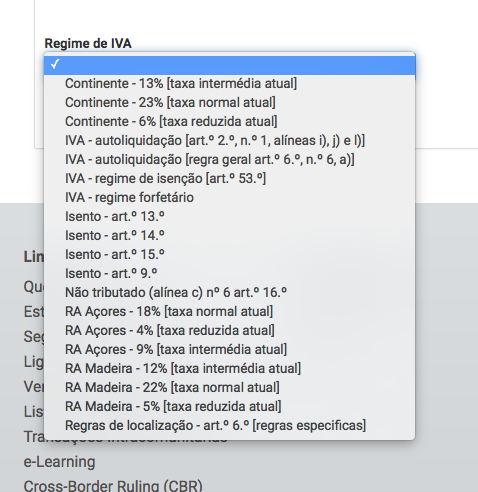

Under the green-circled menu, you choose the VAT scheme for the bill.

If I send it to a registered company in the EU, I select ‘IVA – autoliquidação [regra geral art.o 6.o, n.o 6, a)]’.

In other cases, you choose another VAT scheme that applies.

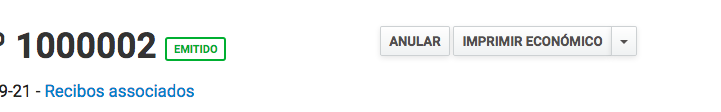

Then choose ’emitir’, submit, at the top of the page. And you will receive confirmation and the option to cancel or print the bill ‘imprimir’:

And that print looks like this, but obviously with filled in boxes.

Lovely green, don’t you think? Not mysterious at all…

Although I only send such a bill to Portuguese customers. To my customers outside Portugal I prefer to send a bill in a format that is customary for them. And then this one is exclusive to the Portuguese Finanças.

Note!

If you have submitted a ‘Fatura’, you will later need to submit a ‘Recibo’ as well when you receive payment!

Useful vocabulary list when making Recibos Verdes:

| recibos verdes | green receipts |

| fatura | bill |

| recibo | receipt |

| emitir | send |

| emitido | sent |

| consultar | consult |

| dados | details |

| adquirente | recipient |

| prestador | supplier |

| bens | goods |

| serviços | services |

| descrição | description |

| IVA | VAT |

And if you don’t email the actual recibo verde to your non Portuguese client, you can just use the stationary familiar to them as they received when you were still sending them invoices from. let’s say, the Netherlands? The only thing different is that your invoice now has a Portuguese NIF instead of a NL tax number. Right?

Yes, that’s what I am doing too.

How do I get all consolidated total amount of the green recipts I have issued. Anywhere in finance portal have any one seen that option

Hi,

If you go to

Faturas e Recibos Verdes > Consultar

in the portal you can choose a period with starting and ending date

with ‘opções’ you can choose the type of documents you want to consult, i.e. ‘faturas’

Below the list of search results you see total amounts.