January 25, 2021

Almost 3 years ago, we wrote the blog post below. It is our most consulted article. And to this day, the article that has received the most reactions.

We are thankful for all those reactions, and the questions we receive by email. And we especially hope that other land movers will be able to import their car in Portugal with less effort than we did.

We are (still) no professional advisers and only describe our personal experiences. Thanks to the reactions of our readers, I do want to give some current additions on ‘importing a vehicle when emigrating to Portugal’.

- In order to qualify for an import duty exemption, the vehicle must have been in your possession for at least 6 months (this used to be 1 year). Source: aduaneiro.

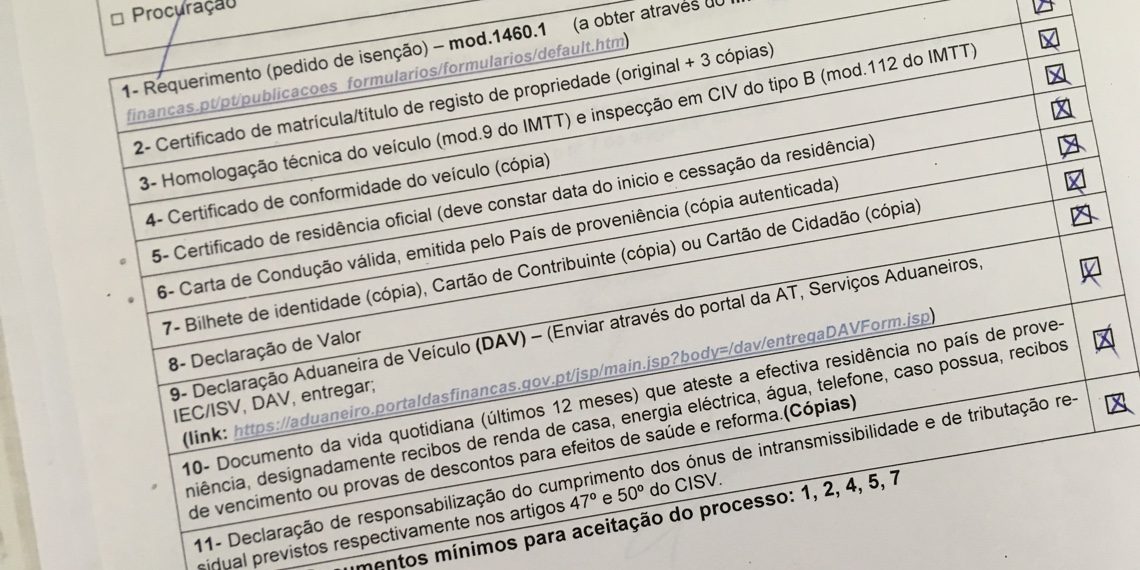

- this is the list of documents required to apply for the import duty exemption: https://info-aduaneiro.portaldasfinancas.gov.pt/pt/informacao_aduaneira/Veiculos/isencao_res

- the Automovél Club do Portugal, among others, offers an import service, on this web page you will also find a simulator for the road tax you will have to pay.

- your imported vehicle, which is exempt from import duties, can be sold without penalty after 12 months. (This was 5 years) Source: aduaneiro.

Here is our story about importing our car during winter 2017/2018

Piece of cake (original blog post from feb 2, 2018)

If you emigrate to Portugal, you’re allowed to import 1 car per person tax-free as part of your household. The procedure can be outsourced to specialized companies and then it probably is a piece of cake.

If you, like us, are members of the do-it-all-yourself club, you can expect a real authentic Portuguese experience. Which you can see as an enrichment of your integration process. It requires patience, perseverance and proper understanding of the Portuguese language. And I’m happy to say that Nuno put our new Portuguese license plates on the Disco today!

In the Netherlands we had two cars: a Citroen C4 on LPG and a Land Rover Discovery. After we were officially registered in Portugal we started with the import procedure for the cars. For this you need a CoC, Certificate of Conformity, which confirms that the car complies with local regulations.

You can request this from a dealer in the country you’re coming from. For the Land Rover we got it very quickly and free of charge. For the C4 it was difficult to get it in the holiday month of August: one dealer was willing to help us for €125, -. So we put the C4 on hold and decided to start with the Land Rover.

The procedure should start off at the district office of IMT

(Instituto da Mobilidade e dos Transportes) of your residency, in our case in Viseu. We took with us: passport, certificate of registration, CoC, original lisence certificate and filled in form ‘modelo 9’ (you can download it here)

Our first aim is to get the car allowed in Portugal and then to arrange at customs that no import tax has to be paid. It is all very disputable because we have free movement of goods in Europe, but anyway…

At the IMT in Viseu we received a print with the procedure explained. (the same info can be found here on the IMTwebsite)

They checked our paperwork and sent us directly to the nearest inspection station.

The Discovery is not an unknown car in Portugal and the inspection seemed to be straight-forward. Until the men of the station saw that the CoC said that the car has 5 seats, while our model only has 2 and is registered in the Netherlands as a company car.

Fortunately, someone from Land Rover and someone from the DVLA in the Netherlands had already warned me about this on the phone. In 2002 both types received the same CoC. The Dutch DVLA man had pointed out to me that on the license card it says with a code that it is registrated as a company car with 2 seats (N1) and hopefully that could convince them in Portugal.

That Friday afternoon, it didn’t. We had to go back to the district office, after the weekend.

At that point we didn’t know yet these things are part of the authentic procedure: You think you are going one step forward, but at the same time something is added or you have to take one step back. An exercise in Portuguese patience …

Anyway, back to the district office: to give an explanation to the head of the department with a few rehearsed sentences. We got a new form for the inspection station again. Unfortunately, this meant that the car is labeled as ‘não está homologado’ and we have to go through a more expensive procedure. The director of the station himself deals with our case. And yes, he starts the technical inspection to allow the car on Portuguese territory! The only restriction is that we have to place a separation fence between the seats and the booth, because that is mandatory. The director trusts our blue eyes that we will do so and gives us the ‘approved’ papers. After we’ve made a fence we can go back to the IMT to collect the new license certificate.

A few weeks later on a Thursday morning we drive back to Viseu with a seperation fence in the car. It is nice and quiet on the road. On arrival we understand why: it is São Mateus. The city saint is honored today and the district office is therefore closed. Another step back and the day after I try again. Then it is quiet because the city is recovering from the hang-over.

When I leave the office, I realize that I have actually been a postman. I have personally delivered the inspection report from the station to them and I had to pay €165. Now we can go to customs to be exempted of import tax.

I try to find out which customs office we need to go and what we need to bring with us. Via the site of the Alfândega (customs) I choose the nearest office and I try to call them for some extra information.

There is some doubt, because they do not know either which office we have to go to due to a reorganization a few years ago.

But in the end it is the office in Braga and I call them to know what to bring with us (in Portuguese!). Fortunately, the employee is patient and can also speak slowly and in simple words and says: ‘Take everything from the list’.

“The list?” I ask.

“Yes, the list.”

Me: ‘And where can I find the list?’

She: ‘You don’t have it? Do you have email? “

Just a few minutes after our conversation I have the list in my mailbox!

Just to be sure, I brought my laptop and our hotspot when we went to Braga.

That wasn’t unnecessarily. Of course there was a error in one of the forms. But I could change it on the spot and sent it in once more. Pfffffff, step by step every box on the list got checked. We succeeded!

A few days later the new Portuguese license certificate arrives by mail. Now we may go to the tax office to pay road tax. Our old Disco from 2002 is charged at the same rate as a car from 2018. A painful observation: instead of €50,- per year we need to pay 10 times more.

In the meantime, we’ve had already realized that we don’t need a second car. So we drove the C4 back to the netherlands and sold it there. Piece of cake.

We’re sorry to say, but after writing this post a reader suggested that the unexpected amount of tax, might be caused by a misstake in the process. Read about it in our follow-up. (sept 2019)

Useful Portuguese words

| License plates | Matrícula |

| License certificate | Certificado de matrícula |

| Imported vehicle | Veículo importado |

| DVLA | IMT (Instituto da Mobilidade e dos Transportes) |

| application | Pedido |

| File | Fiche |

| Form | Modelo |

| Address | Morada |

| Brand | Marca |

| MOT test | Inspeção técnica periódica |

| MOT test station | Centro Inspeção Automóvel |

| Certificate of Conformation | Homologação |

| Declaration | Declaração |

| Douane | Customs |

| Tax | Imposto |

| Tax office | Finanças |

Hi Dona Rolha,

Just stumble into this post (have no idea how old it is) but I have good news for you: starting next fiscal year, your Disco road tax should be around 60Eur (the same as a 2002 registered LR) – this has been through the Parliament and is to be part of the next budget.

That is wonderful news Marco, for everyone!

Thanks for your comment. Abraço!

Hallo!

Heeft u enig idee of u ook registratie moest betalen speciaal voor het LPG gedeelte?

Dankjewel voor je reactie.

Ik kan je helaas geen antwoord geven op je vraag.

We besloten onze auto op lpg alsnog te verkopen in Nederland, enerzijds omdat in onze regio de lpg stations dun gezaaid zijn en anderzijds omdat onze lpg installatie later was ingebouwd en niet op de COC vermeld stond. We hadden na de importperikelen met onze landrover onze portie bureaucratie wel gehad.

Hello. Thanks for writing this blog. So from your article I am. Presuming it is much better to being a privately ownes car I to Portugal than a business vehicle? Or. Maybe its a matter of making sure it is registered as the correct type when entering… All seems so complicated.

Hi Stephanie, Thanks for your comment.

A business car will be cheaper for road tax.

And your last comment is definitely true: make sure that your car is registered as on de Certificate of Conformity (from the EU).

That makes the whole process much easier!

Thanks for your help. I look forward to finally getting to Europe and getting this process started. I am coming from South Africa. I will buy the car in Germany as cars are cheaper there than in Portugal. I’ll then drive it to Portugal. I hope this does not complicate matters much.

Hi Stephanie, thanks for the comment.

If you want to avoid the import tax, you need to prove that you own the car for more then a year.

Okay, wow. Guess I will live in Germany for a year 😉

i think you are wrong,its 6 months ownership from date of registration + 6 months residence continuous residence in the country where the car is registered. that info is from the latest portuguese official websites, government and customs

Thanks Terry!

You are right. I will change the info in the blog

Hallo!

Dankjewel voor dit uitgreide informatieve artikel!

Ik heb een vraag. Graag zou ik mijn Fiat Panda in Portugal willen importeren, echter bij het opvragen van de CVO, blijkt dat deze niet bestaat. Is het dan uberhaupt mogelijk om mijn auto te importeren?

Ik ben heel benieuwd. Ik kon zo 123 het antwoord niet vinden op internet.

Dankjewel alvast.

Vriendelijke groetjes,

Eva

Hi Eva, dank voor je reactie.

Je schrijft CVO, maar ik denk dat je het Certificate of Confirmity (CoC) bedoelt, hè?

Ik kan me bijna niet voorstellen dat dat er niet is voor de Fiat Panda. Heb je contact gehad met een officiële Fiat dealer?

Op basis van onze ervaring, zou ik me niet aan het import-proces wagen zonder CoC.

Als je de auto niet wil missen in Portugal, kun je het voorleggen aan een import-specialist. Zij kunnen je vast direct zeggen of de Panda zonder CoC wel of niet in te voeren is.

Op facebook kun je in de expat-groepen wel vragen/zoeken naar zo iemand.

Succes en groet!

Hi!

Ja idd, COC, volgens mij zijn de CVO en COC hetzelfde.. Ik heb inderdaad contact gehad met Fiat, zij zeggen dat het er niet is en ook nooit geweest. Hoewel de auto uit 2004 is, niet eens zo oud.. Ja ik zal idd eens een import specialist inschakelen. Dankjewel voor je snelle reactie!

Groetjes,

Eva

Can anyone recommend an outsource company as our vehicles are complicated. One car, one Motorhome both Spanish plated whilst we are one UK and one EU resident!!!!!!!!!! Far too complicated for us to manage. Any suggestions would be much appreciated

Hello Vanessa, we can not recommend anyone ourselves. But maybe in the various facebook-expat-in-portugal-groups, you will find a company name. I hope you’ll manage with importing your cars. Good luck!

These guys are good: https://www.autodoc.pt/

Hi I live in Lagos, I have my NIF and Residencia, I want to import my Mitsubishi Space Gear 4×4 MPF but I can not get a COC because it was a Japanese import to the UK. I emailed Mitsubishi UK for the COC they referred me to Mitsubishi Japan and they will not issue me one because they don’t issue documents to people. The DVLA issue all Japanese imports with a 13 didget VIN and the companes I have engaged to find me the COC all say the require a 17 didget VIN..

Can I import my vehicle without a COC.

Michael

Hi Michael, yes you can. You just have to pay more at the IMT and have a more detailed inspection.

Follow this link and then under “Sem Certificado de Conformidade (CoC) e sem Homologação Nacional” you will find the required documents.

If I were you, I would check if you see your type of car driving around with Portuguese plates.

If they have done it, so can you!

Good luck

Hi Dona, first of all thank you for this article which helped me quite a lot at least to start the process. My job is so demanding and I am thinking to rely on an agency to finish the process which is telling me a few unexpected things. If you could help I have a few of questions for you:

1 Is it true that you may also not present income from work in Portugal before the date of cancellation of residence in the country of origin in order to not pay taxes?

2 is it true that the application for tax benefit must be submitted no later than 6 months after the date of cancellation of residence (in your own country) ?

3 Can you confirm that if I moved my residency in Portugal I can drive with the original documents of the car for the first year in Portugal?

4 last one, Do you know if I don’t pay taxes how much I need to wait before I can sell it?

Hope this is not too much, I’d be happy to pay for breakfast or a drink if you are ever in Lisbon. these info are gold to me.

Hi Jo. No thanks, just sharing our experience.

That being said, we only know things from our own experiences, so I can not provide any official information.

I will try to answer your questions:

1. we don’t know. 2. Yes, that’s true. 3. I can’t confirm that. But I was stopped by the police once, while still having Dutch plates in our 4th month. I explained we were in the process of getting Portuguese plates and got away with that. But I am not sure if they would have let me go without a fine if it was in our 11th month…

4. It used to be 5 years, but I remember something about shortening that period to I don’t know how many, years. (3, 2 or 1).

Thanks for offering breakfast, you don’t need to.

Greetings from the north, good luck.

Hi, and Hello everyone;

I have a 2016 Range Rover Sport from the United States with Virginia license plates, currently I am driving it in Morocco and I moving to Portugal do you know if it still qualify for the import duty exemption?

Thank you

Hi Norm,

There’s nothing in the regs about where the car has been driving.

It is just about ownership.

But please be sure to check the regulation yourself (if needed with google translator).

Because we are EU citizens, it might be different if the car comes from outside the EU.

Boa sorte e bom viagem!

Norm,

Did you figure out how to import your RR? We are stuck on getting the certificate of conformity. Since our car is from the U.S. we cannot get an EU COC. When we request this from Subaru in the U.S., they are confused and don’t understand what is needed.

Can anyone on this forum shed light on obtaining the needed COC for a U.S. car? We’ve seen lots on taxes but not much on the COC.

Many thanks,

Brook

Hi Brook,

Since we are from the EU ourselves, we don’t have any advice for you on this one.

Are you on facebook? There are some really helpful groups there, with many US members.

For instance this one: https://www.facebook.com/groups/expatsinportugal

Hallóóó,

Wat een leuke blog hebben jullie. Wij zijn Ay Lin en Jaap-Willem en hebben alles ineens gelezen over jullie renovatie. Wij gaan ook een ruïne-opknap doen ten Zuiden van Coimbra. Ik heb vorig jaar kort een blog bijgehouden van onze tijd in Pt. Maar het gaat bij ons allemaal nog beginnen met de verbouwing van het huis…. in mei gaan we er 2 weken naartoe en eind juli, met de auto…

Wellicht tot ziens in Pt!

groet,

Ay Lin

Hi Ay Lin, wat goed om te horen dat jullie ook een huis gaan opknappen in PT.

Er staan zoveel wegkwijnende juweeltjes in dit land. Hoe meer mensen deze nieuw leven inblazen, hoe beter.

Hou ons op de hoogte! Boa sorte e abraços

Hello, good to read the successes people have importing their cars into Portugal!

I have a very different story. I’m a British 2006 Porsche 911 owner who took up residency in Portugal in late December last year. In advance of leaving I contacted Porsche for a Certificate of Conformity. Only on arrival in Portugal did I discover they won’t provide one. they claim my vehicle has no CoC. I have contacted several different departments in Porsche. I have contacted the original dealership, the Porsche dealer in Portugal have tried to get this for me, and I even wrote to the Chairman of Porsche AG. Basically it seems Porsche system has failed and they no longer have the records.

Does anyone have any advice on what to do? It seems that without the CoC I am stuffed and may need to take my car back to the UK. What I find extraordinary is that this system of importing a car requires paperwork I simply cannot provide!

Thanks – any advice appreciated.

Hello Phil,

We also didn’t have a COC for our vehicle, but you can still import your car without one. The IMT has an option to import it without having one. You just need a specific stamp from them on your IMT Model 9 form. I would contact them about this.

Hope this was helpful. Let me know if you need any more information.

All the best,

Eva

That’s great Eva! Thanks for sharing your experience.

Abraço!

Thanks for this, Eva. We’ve been in contact with our regional IMT in Santarém several times and explained our lack of European COC with a U.S. vehicle. We’ve not been given the stamp option you’ve mentioned in order to move forward with our process. They seem to indicate that we must get in touch with a Portuguese Subaru dealer which doesn’t exist according to Subaru U.S.

IMT has had us submit a formal request for them to provide us with the correct Subaru officials in Portugal so that that can get what is needed for the Model 9 form. We were told it would take a week to get a response. Meanwhile, we contacted an agent who handles these matters and they said Subaru U.S. should provide us what is needed. Subaru U.S. is clueless on a COC valid for Europe.

Eva, was some specific language needed to request moving forward with the process using the IMT stamp instead of a COC? We are at a loss on this whole process and also confused by the 20 day deadline to submit the DAV. Based on what we see you can’t submit the DAV without a European matriculation which is what we are seeking in the first place. We’re getting mixed info on when the DAV must be done. We see 20 days online but we’re being told we have 12 months to do it.

We’re finding this to be a real chicken and egg type quandary.

Thanks for any additional details that you might provide!

Eagerly watching for a reply to this. I have a 2005 Boxster S and also want to import it (from USA) when my wife and I come to Portugal in a year…

Hi thanks for sharing your experiences. I have some questions I am not EU citizen but I live in Lisbon I have residency.Right now I am in Dubai and wanna buy jeep my question is that is it possible to bring my car from Dubai to Portugal? Are there any restrictions ? Am I gonna have to pay taxes? I am looking forward to your answers Thanks in Advance

Hi Rashad,

Sorry, we don’t have any experiences with imports from non-EU countries, but i guess it will be equally frustrating as from a EU country (+costs for customs and IVA).

check this site: https://europa.eu/youreurope/citizens/vehicles/cars/vat-buying-selling-cars/index_en.htm#buying-non-EU-1

And nevertheless: Good luck!

Dear Dona,

Thanks so much for your article which is very helpful and explains the process in principle.

However, I’m wondering if this still applies as the UK has now left the EU?

As to my own situation I’m living between both countries and would like to take and register my 12 year old UK registered car to Portugal later this year. I’ve property in Portugal and plan to retire there in some years.

Very many thanks for your advice in advance,

Best wishes,

Markus

Hi Markus,

This article was written to share our experience with importing our DiscoveryII as part of our emigration to Portugal.

(If you emigrate to Portugal, you’re allowed to import 1 car per person tax-free as part of your household.)

ISV exemption is possible for all emigrants (EU and non-EU), considering you meet all criteria.

See this useful page:

https://impostosobreveiculos.info/importacao/brexit-importing-a-vehicle-from-the-uk-to-portugal/

With regard to the annual tax (IUC) in combination with Brexit things are still a bit unclear.

It could well be that a car imported from the UK after 2021 will pay IUC based on the Portuguese date of registration.

Please check this useful page:

https://impostosobreveiculos.info/english/testimony-bring-your-car-along-with-you-to-portugal-without-paying-isv/

So if you are really fond of your car and would like to have ISV exemption, I suggest you make a new plan:

Make your car-import part of your actual emigration.

Best wishes, Nuno.

Thank you for writing this very helpful article.

Do you have any idea how to obtain a COC when your manufacturer refuses to give one due to the age of your vehicle (2002 Mercedes)

Olá Andy, thanks for the compliment.

I wouldn’t know how to obtain a CoC.

Have you tried a Mercedes forum/facebook page in the country your Merc is from? Maybe someone has one and can make you a copy.

Boa sorte

I am trying to figure out the tax exemptions/import tax if I import an all electric car from the EU to portugal. Are there any sources for this question? Thank you

Nice question,

I found this informative site where it says (translated):

“Exclusively electric cars, that is, those that do not have an internal combustion engine running on diesel, gasoline or any other fossil fuel (gas, natural gas, liquefied petroleum gas, etc.), are, at the date of this article and without changes foreseen in the next ones. times, completely exempt from ISV and IUC, as long as the Portuguese enrollment date is after June 2007.

This applies to cars of any kind (passengers, goods, etc.) new, domestic used and used imported from the EU or any other country.”

Check out the site to read more about the subject (in Portuguese):

https://impostosobreveiculos.info/comprar-carro/os-automoveis-electricos-pagam-que-impostos/

Good luck with the import of your electric car!

I am moving to Portugal in the next two years, I am very happy to know that I can bring a car from Ireland to Portugal, I am still looking for a a bit of land to buy and gathering as much information as possible before I make the move, I am very glad to come across this blog, thank you so much guys, all the best, hope you are having a good time in Portugal

Muito obrigrada! Thank you for your kind words.

Yes, we never regret our move, hope you won’t either when you make the jump.

Boa sorte!

Hello. I’m from the UK and it took forever to get my resident status set up here and so i missed the Brexit car import deadline. Now i’ve been stuck with my vehicle here off-roaded as the cheapest quote i’ve been able to get is 2,700 euro, twice the price of the vehicle.

This advice appears to be for people coming from EU nations, for those from the UK it seems pretty much impossible now.

Hi Andy, thanks for sharing your personal experience.

Although it’s bad news for you uk-ers.

Very helpful article. Kudos to author.

Obrigada Richard

good morning

i’m in confused mode today, as usual, but can you put me on right path please. i’m in process of getting our car registered here, we’re british nationality but were legally french residents until late july this year when we moved here and in process of obtaining residence permits. car is french registration, and has a COC.

looking at your copy of ‘legalizacao veiculo importado’ with 3 columns of steps to follow can i assume that because i have a COC issued by Skoda that i go direct to the inspection centre first then after to IMT with modelo 9………………………….as per the right hand column ?

i think i misinterpreted something a few days back on the government site and filled in a request for homologation, attached the COC and vehicle papers when i didn’t need to. i did recieve a document back “Consta do registo de homologações deste Instituto, que à homologação europeia/variante/versão indicada, foi atribuído o seguinte número de registo:”

regards

terry

to update myself, despite having a COC you still need to get a certificate of homologation from IMT which basically restates everything already on the COC

Thanks for the update Terry.

Despite being it, muito chato!

Yours is the best blog post we’ve found so far on the topic. We’re trying to legalize a car from the U.S. and already can relate to your experiences with some chuckles. Thank you for posting this!

Brook

Thank you, Brook.

Hope you will succeed! Boa sorte!

Hi

Can anyone please explain this from this article: https://eportugal.gov.pt/en/servicos/pedir-a-isencao-do-imposto-sobre-veiculos-quando-se-vem-morar-para-portugal

have purchased the vehicle in the country of origin or in a country where resided previously and paid all the required taxes in that country, without profiting from any fiscal benefit when the vehicle was brought to Portugal.

I am moving from Andorra where car tax is 4.5%, is that a fiscal benefit?

Thanks v much for your help!

Hey guys, I read somewhere you should import your car within 20 days after entering portugal. Is that so? Thanks!!

Olá Max, I can’t remember reading that somewhere.

Please share the document/link.

Nevertheless, I wouldn’t bother too much about it. No one ever commented on us for not being within the deadline…

And anyone who manages to import a car within 20 days, deserves a statue!

Boa sorte

you should start the process within 20 days of entering portugal. be warned you have to do it with the customs guys, and have a contribuinte (tax) number, and you can fill in a form online but its a nightmare to fill in, the interface is hopelessly out of date. i would suggest going to the nearest customs office and doing it in person, if possible these days, it will be much faster and less stress.

Wow, please can you let me know the time scale, we applied within the 20 days. But arrived here in 3 months lockdown. We registered both cars with ACP and finally after their incompetence got my wife’s car all sorted. However, my car was tested in May 2021, and failed on headlights. This has been a nightmare to address, my garage closed and didn’t tell us, and finally I sourced them and got them fitted they were faulty. Long story, but its now passed and went back to ACP to continue the process for them to tell me I have gone over 1 year and have to pay tax of 7000 euros! I started in April waiting 3 months for restrictions to be llofted. I have written to IMT and ACP management, but heard nothing. Surely I have started the process? She says she needs to start a file!! Yet I am clearly on their system as is my wife. How do I appeal? Any help appreciated as the car isn’t worth this money. And I couldn’t get out until late April anyway. many thanks

That’s really bad, Rob. We are in no position to offer you any help because we are no (import/law) experts/specialists. Hope you will find someone who can. All the best

Hi all – very helpful article and discussion. Regarding the rule “one car per person per household” … do you know if it will be a problem if both cars are registered in my name? (We want Portugal authorities to recognize one car as mine and one car as my husband’s.) Thanks in advance for any insights.

Hello Wanda, thank you for the compliment.

You can import multiple cars, but you can only apply for import tax exemption for one car a person.

(source q&a below this article: https://impostosobreveiculos.info/importacao/isencao-por-mudanca-de-residencia-condicoes-e-procedimentos/)

Adeus!

Hi there, Thanks for all the useful info. I too did a diy approach for my transit van and after uploading 70 documents to the DAV portal I finally got my tax free import!

I now have a motorbike to bring over. It belonged to my recently deceased husband who had it shipped here before his death. Now I have to register it in my name with the DVLA before registering it here in Portugal. My question is; am I allowed to import a second vehicle? Obviously, it wont be tax free. I’m kind of sitting between two bar stools, as it were!

Boa tarde! Thank you for your comment. 70 documents, you are probably not kidding.

As far as we know you can import another vehicle. The 1 vehicle limit is only in effect for the import tax exemption.

Abraço!

Hey folks,

Thanks for posting your story. I have an old 2006 Renault Megane that I’m hoping to import next year (Jan, 2023) when I move to Portugal (currently applying for my D7 Visa back in the UK). I’ve owned the car for several years and it’s been SORN for the past 5 or so years. Given the SORN period, year and manufacturer of the vehicle can you see me running into any problems? I’m hoping to get a tax exemption also.

Is there a rush on any applications once I arrive in Portugal, or I have 12 months from my date of entry to start the process?

Thanks,

Rich

Hi Rich,

I don’t think the period that you took your car off the road will be a problem. There will always be some delay in the process, so best is to start the process right away once you have settled.